Amazon Pantry, Amazon Go at Airports, Profit vs Growth

By Cleveland AdminAfter years of varying strategies and performance, Amazon is looking to revamp Pantry by expanding it to more customers and seeking meaningful support from manufacturers. According to our research, Pantry has been reinvigorated with a new team that is looking to expand it to a greater set of customers, offer it to non-Prime members ($5.99/box) and also offer free shipments to Prime members (prior $5.99 for orders below $35). The Pantry team has also looked to offer the Buy More, Save More promotion throughout the year, and is going to the manufacturer community to fund that investment. However, we expect Amazon will struggle to gain manufacturer support for Pantry in 2020 given the high cost and the lack of clarity around the long term role it will play in Amazon’s grocery strategy.

Amazon Selling Cashierless Technology to Airports

This week, Amazon and airport vendor OTG announced that Amazon’s cashierless technology used in its “Amazon Go” stores would be featured at several locations at New York area airports. Amazon and OTG highlighted the convenience of the system for consumers by eliminating lines, but some questions remain about the cost and flexibility of the system, in addition to the data access that Amazon will get from these locations. This also calls into question Amazon’s plans for its new brick and mortar locations as some are theorizing that these locations are simply trial locations for the tech, while others see them as a more significant part of Amazon’s growth strategy, particularly in the grocery category.

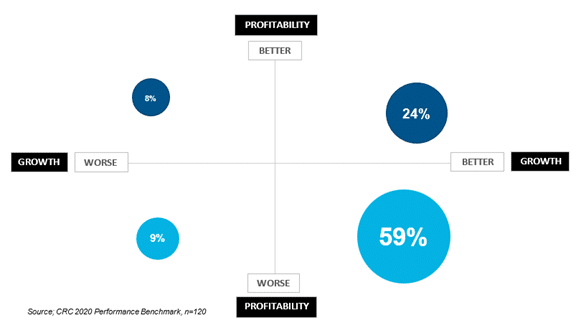

Brands feel Better on Amazon Growth and Worse on Profitability

Over the last several years, Amazon has transitioned from an account with better than average profitability to one that tends to be less profitable than manufacturers’ other retail customers. In this year’s benchmark, a net 21% of respondents say Amazon is less profitable than other customers, which is about in-line with the results from last year and much less profitable than 2016 and 2017, and certainly less profitable than 2015. As manufacturers look out into 2020, over 50% of manufacturers expect better growth but worse profitability in 2020 compared to 2019.