Amazon Media; Social Commerce Update; Material Acceleration in eCommerce Growth

By Cleveland AdminAmazon’s advertising business grew 44 % during 1Q (ending March 2020), up from 41% during the prior quarter. In our research, 1P manufacturers on average were increasing the amount of spend with Amazon’s paid search advertising units (AMS), citing continued positive ROI’s and the reduction in other promotional vehicles like deals and coupons as key drivers. While we continue to hear positive trends in AMS into 2Q20, we expect greater pressure on Amazon’s media business (AMG), as this segment is exposed to non-retail categories like media and travel. Many of these categories are under extreme pressure and have cut back marketing spend accordingly. In addition, our research suggests even manufacturers in the retail space have also cut back on upper-funnel advertising spend, placing additional pressure on Amazon’s AMG unit.

Facebook makes progress on social commerce

Earlier this week, Facebook announced it is launching a new feature called Shops on both Facebook and Instagram, enabling consumers to browse and buy directly from a brand or retailers store. The company indicated will charge a commission rate on each purchase and has partnered with Shopify, BigCommerce, Woo, Channel Advisory, CedCommerce, Cafe24, Tienda Nube and Feednomics to enable this capability. While we have yet to see eCommerce take off for Google or social platforms, our consumer research has suggested growing discovery, research and a desire to purchase directly from these platforms. We also estimate Facebook has a greater desire to more closely link purchasing on its site, in order to drive a more direct ROI from advertising, much like Amazon has been able to do with its paid search advertising options.

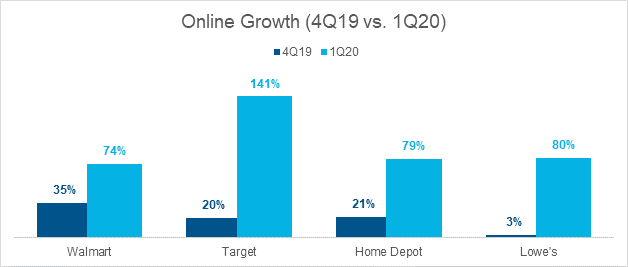

Mass & Home Improvement retailers see massive increase in eCommerce Sales

Walmart, Target, Home Depot and Lowe’s all reported significant growth in eCommerce sales during the most recent quarter ending in April, with very strong momentum into May. These omnichannel retailers called out store-based activities like fulfillment as being a major contributor to the results. For instance, Target indicated 80% of digital sales were fulfilled by stores, and Home Depot indicated Buy Online Pick Up In Store accounted for 60% of its digital mix, up from 50% last year. There was differing impacts to margins as a result of the growing mix of digital sales. Walmart indicated the mix shift to eCommerce partially contributed to gross margins down 113 basis points during the quarter and Target indicated it contributed partially to the 450 basis points of pressure it saw in the quarter. However, Home Depot indicated it did not see pressure from the channel shift, as BOPIS accounted for a large amount of the business.