Amazon LTL, Holiday Advertising, Short Orders

By Cleveland AdminOur research has indicated that Amazon has shipped more LTL freight using its own network over the last few months, rather than using external LTL carriers. This is a continuation of Amazon’s efforts to develop internal freight capabilities as it looks to improve delivery speeds while minimizing costs. Amazon has seen its shipping costs increase 35% YTD as it rolled out one day Prime shipping, and shipping costs increased to 16% of retail sales during 3Q19. We recommend vendors be prepared for Amazon to bring up increased shipping costs during annual vendor negotiations as a catalyst for increased vendor support.

Kenshoo Data Shows Commerce Marketing Advertising Up Significantly Y/Y

Data from our partners at Kenshoo indicates that advertisers ramped up spending on commerce marketing platforms (mainly Amazon) from Thanksgiving through Cyber Monday. Kenshoo’s data shows that on a Y/Y basis, advertisers spent 20% more on Thanksgiving and 30% more on Black Friday. When compared to earlier in November 2019, cost per click was up 10% on Thanksgiving and 29% on Black Friday. Our research continues to show strong ROAS for commerce marketing offerings, particularly for search based offerings such as Amazon’s Sponsored Products, which is still the vast majority of ad spend on the platform. We expect manufacturers will continue to increase spending on Amazon’s ad platforms in 2020 in an effort to maintain and grow share. In addition, we expect significant increases on other commerce sites like Walmart, Target, and Kroger as these retailers develop more sophisticated offerings.

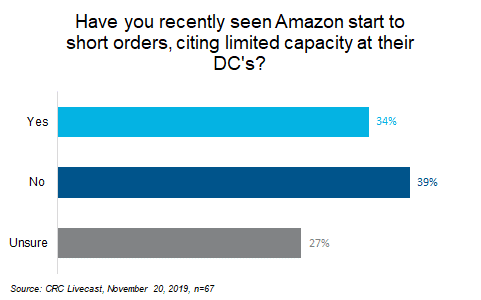

Amazon Shorting Some Manufacturers’ Orders

While consumer eCommerce demand has been strong to begin the holiday season, some manufacturers have seen Amazon short orders due to capacity constraints at FCs. During our LiveCast in late November, approximately 1/3 of manufacturers surveyed indicated that they have seen this behavior from Amazon. In addition, of those who saw short orders, most did not receive explicit communication from Amazon regarding the matter. In our research, several manufacturers that had received lighter orders in October did see a return to normal patterns this week. The volatility in orders makes it difficult to plan, so we would recommend remaining as flexible as possible in your manufacturing and supply chain.