Amazon & Instacart: DSP Investment, Ad Spend, and Product Page Advancements

By Cleveland AdminAmazon DSP (Demand Side Platform) is an important component of brands’ Amazon Advertising strategy due to the prevalence throughout the consumer’s path to purchase, as well as Amazon’s growing influence in areas outside the shopping site, such as Twitch and Fire TV. According to our benchmark, 75% of all brands surveyed are investing in Amazon DSP. For Food & CPG brands, Amazon DSP is expected to reach ~6% of wholesale sales in 2021 compared to ~10% for Console (paid search/AMS) spend. For General Merchandise brands, DSP is expected to reach ~5% of wholesale sales in 2021 compared to ~7% for Console spend.

Instacart Product Pages:

Brands now have the opportunity for more control of their product information on Instacart through the platform’s new “Product Library,” available to existing brand advertisers who are not using a service provider. Previously, brands had to track down point of contacts at each individual retailer in order to adjust product content. This streamlined process will be better for the manufacturer community as well as for consumers and retailers. The Instacart platform continues to demonstrate improved capabilities as they become a bigger contender in the grocery space.

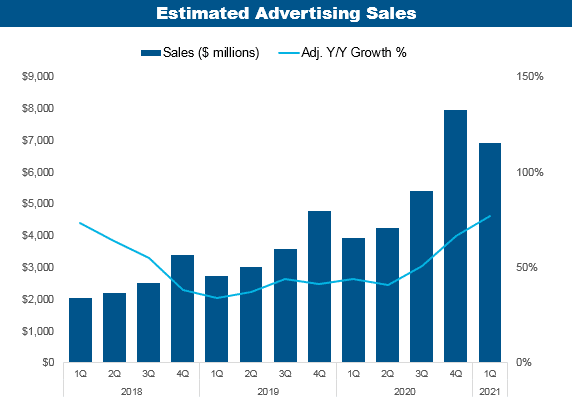

Ad Spend on Amazon:

Amazon’s advertising segment grew 77% Y/Y in 1Q21, up from 66% Y/Y in the prior quarter. The total business reached an estimated $6.9B in ad sales, compared to $25B for Facebook and $32B for Google search revenues. Management commented that higher site traffic, improving ad relevancy, and new ad products (such as sponsored brand video ads) all contributed to the positive growth trend. We expect the second quarter to continue to deliver positive results within this business segment for Amazon as many manufacturers pulled back on Amazon ad spend last year due to heightened uncertainty or because their items were temporarily halted from selling. This sets up Amazon for an easier comparison. Prime Day-related ad spend is also expected to fall into 2Q as well this year. In addition, Amazon is uniquely positioned to continue to grow this segment as brand manufacturers steadily shift more dollars into retail media networks with Amazon the furthest ahead in terms of functionality and reporting.

Source: Company Reports; CRC Estimates