Amazon: Increasing concern around holiday sales, Fresh 2023 B&M store halt, layoffs, Black Friday & Cyber Monday Deals

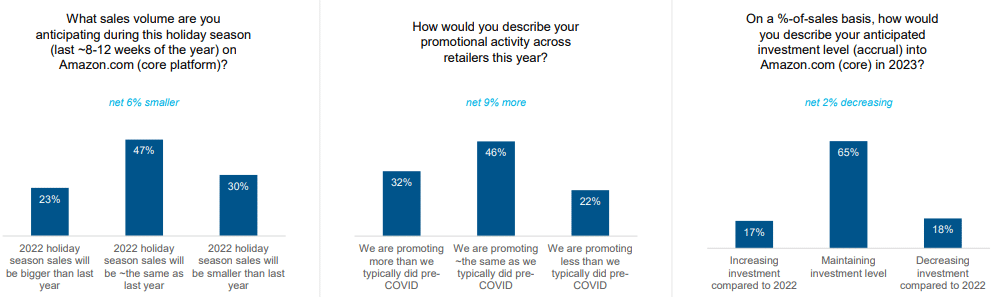

By Cleveland AdminFrom CRC LiveCast: brands anticipating negative holiday sales Y-Y:

In our latest LiveCast webinar, we polled the audience and found that a net 6% of brands expect 2022 holiday season sales to be negative compared to last year. This dampening of expectations has materialized over the past couple of weeks where previously in our 3Q22 Amazon Vendor Benchmark, a net 25% of Food & CPG brands and a net 9% of General Merchandise brands were expecting a larger lift for this upcoming holiday season compared to 2021. Additionally, a net 9% of brands on the webinar described their promotional activity across retailers this year as greater than they typically ran pre-COVID.

Amazon Fresh 2023 B&M expansion potentially halted:

Over the last two weeks, we have increasingly heard Amazon will likely halt 2023 Fresh B&M store expansion plans. In this scenario, U.S. B&M store count would remain at 44 for all of 2023. This change in prior strategy aligns with Amazon’s recent focus on reducing costs/unnecessary spending. On Amazon’s last earnings call, operating income was less favorable than anticipated with Amazon falling $500M short of its cost improvement target for the quarter. The 3 main margin drags Amazon called out were: 1) productivity challenges, 2) fixed cost leverage, and 3) inflation. In attempt to improve fixed cost leverage, Amazon has reduced its build expectations for its retail business/fulfillment centers moving forward ($10B reduction) – which would be in-line with the decision to halt Fresh B&M store expansion plans for the time being.

Amazon’s 2022 Black Friday & Cyber Monday Deals – comparing to 2021:

Amazon’s Black Friday sale will be a two-day event (11/24 & 11/25) starting on Thanksgiving Day. Its Cyber Monday event will begin Saturday 11/26 through Monday 11/28 (same as 2021).

In terms of type & depth of discounts, our team has created these high-level takeaways:

- Amazon devices discounts are comparable in depth of discounts, 2022 selection is strong & similar to 2021

- Broader number of Fashion discounts Y-Y

- Less Beauty & Personal Care discounts Y-Y

- Deeper and broader discounts in Electronics Y-Y

- Advertising ‘$X & under’ across all categories & a wide range of price points $10-100

- Apparel, Electronics, Amazon devices, Kitchen accessories being promoted heaviest

- Black Friday appears to cater to ‘people shopping for themselves’ while Cyber Monday seems to be more focused around giftable products

Amazon devices discounts are comparable in depth of discounts, 2022 selection is strong & similar to 2021 - Broader number of Fashion discounts Y-Y

- Less Beauty & Personal Care discounts Y-Y

- Deeper and broader discounts in Electronics Y-Y

- Advertising ‘$X & under’ across all categories & a wide range of price points $10-100

- Apparel, Electronics, Amazon devices, Kitchen accessories being promoted heaviest

- Black Friday appears to cater to ‘people shopping for themselves’ while Cyber Monday seems to be more focused around giftable products

Amazon layoffs – plans to cut ~10K employees:

The New York Times reported Amazon plans to layoff ~10K employees, specifically in the devices organization (Alexa), retail division, and human resources. This layoff would represent ~3% of Amazon’s corporate employees. It would also be the largest cuts in Amazon’s history.