Amazon DSP, BigCommerce Partnership & Post COVID-Consumer Survey

By Cleveland Admin

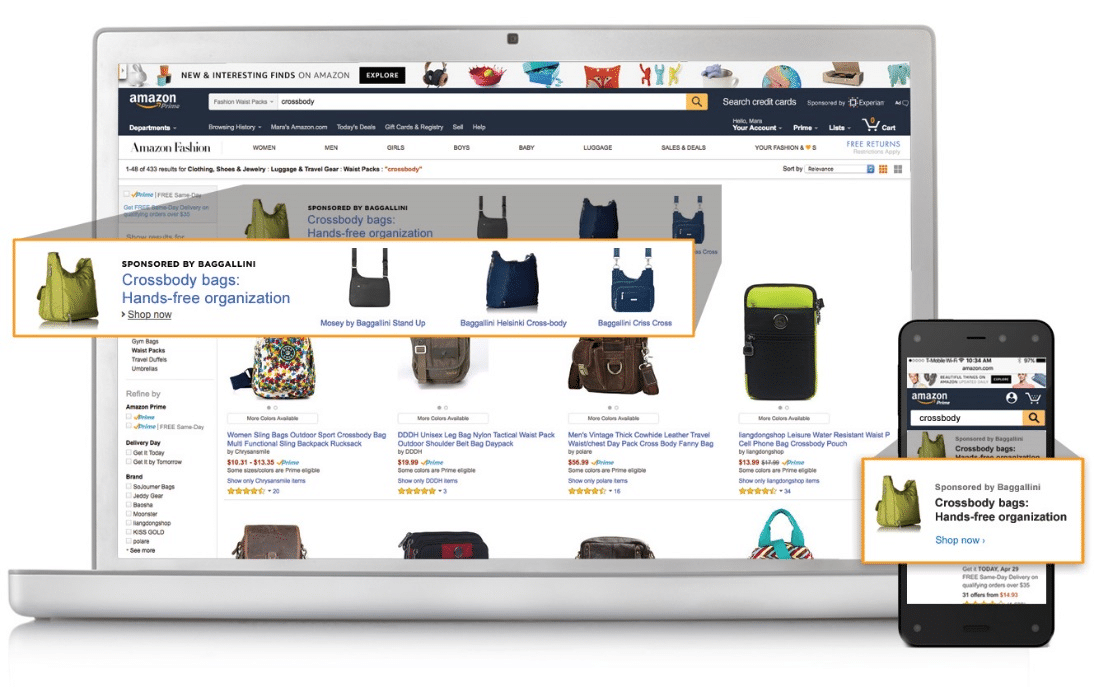

While Sponsored Products (paid search) remains the biggest focus for brands advertising on Amazon, brands continue to expand beyond paid search to leverage Amazon’s broader advertising capabilities, to reach consumers higher on the funnel, and as CPCs are generally rising (and therefore ROAS is relatively declining) within paid search. Our Amazon Advertising Benchmark suggests 75% of brands are investing in Amazon DSP (Demand Side Platform) as part of their advertising strategy, and spend is expected to increase this year by about 25% on average. Amazon has recently introduced some new DSP developments with positive feedback including new home page display ads, an overall increase in home page ad inventory, the ability to clone DSP campaigns, and the ability to buy Twitch audiences.

Source: TeikaMetrics

BigCommerce merchants can now leverage Amazon MCF:

This week BigCommerce announced a partnership with Amazon Multi-Channel Fulfillment (MCF) in which BigCommerce merchants can now leverage FBA to fulfill orders. For consumers, key benefits include fast shipping, upfront delivery promises, and fully trackable orders. Meanwhile, merchants can enjoy simplified operations, competitive pricing on fulfillment and storage with no peak surcharges, and full control over the cost of shipping for customers. We see this announcement as an illustration of the complexity and difficulty that comes with building a successful eCommerce experience, so much so that BigCommerce partners with Amazon could also be viewed as a key competitor of the BigCommerce platform. Robust capabilities are required for a successful experience for the consumer, the supplier, and the retailer or merchant, in many cases requiring significant in-house investments or otherwise external partnerships.

Source: BigCommerce

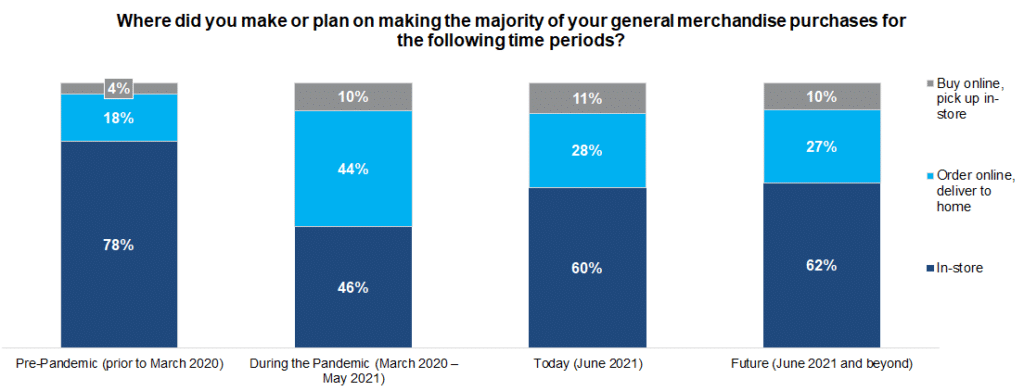

Consumer study suggests shoppers are returning to stores, albeit not to pre-pandemic levels:

In our most recent COVID-19 Consumer Sentiment Survey 35% of consumers report they have completely returned to their pre-pandemic routine. With that, there has been a reversion back to in-store shopping, with 60% doing the majority of their general merchandise shopping in-store compared to 46% during the pandemic. Looking ahead, however, there are only an additional 2 points (62%) expected to return in-store. This suggests we are likely at the cusp of “new normal” shopping behavior and compares to 78% of consumers doing the majority of their general merchandise shopping in-store pre-pandemic. In other words, the data suggests consumers are certainly returning to stores at the expense of online, but a meaningful amount of share likely stays online compared to the pre-pandemic mix.

Source: CRC Consumer Survey, June 2021, n=641