Income Level and Amazon Shoppers: The Consumer Insights You Need to Know

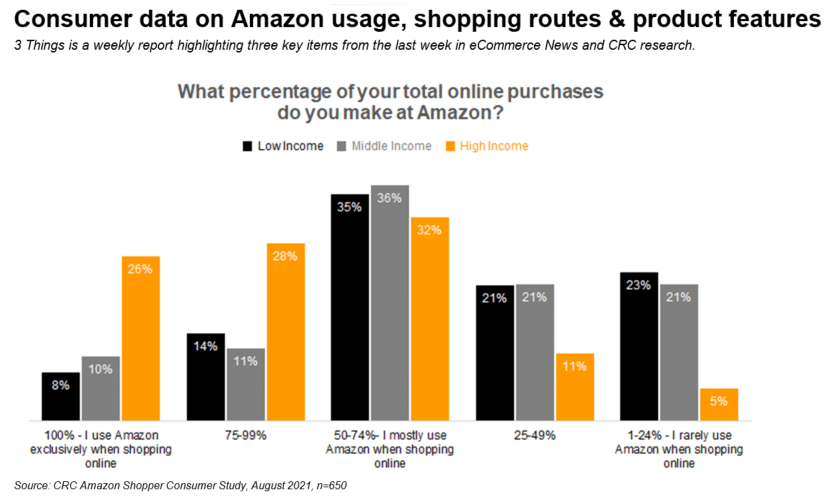

By Cleveland AdminOur Amazon Shopper Consumer Study suggests high income shoppers rely on eCommerce, and Amazon in particular, much more heavily than low and middle income Amazon shoppers. On average, high income shoppers are doing 57% of their annual purchases online, and 74% of those online purchases are done with Amazon. This implies that roughly 42% of all purchases made are through Amazon, compared to ~20% of all purchases completed through Amazon for low and middle income shoppers.

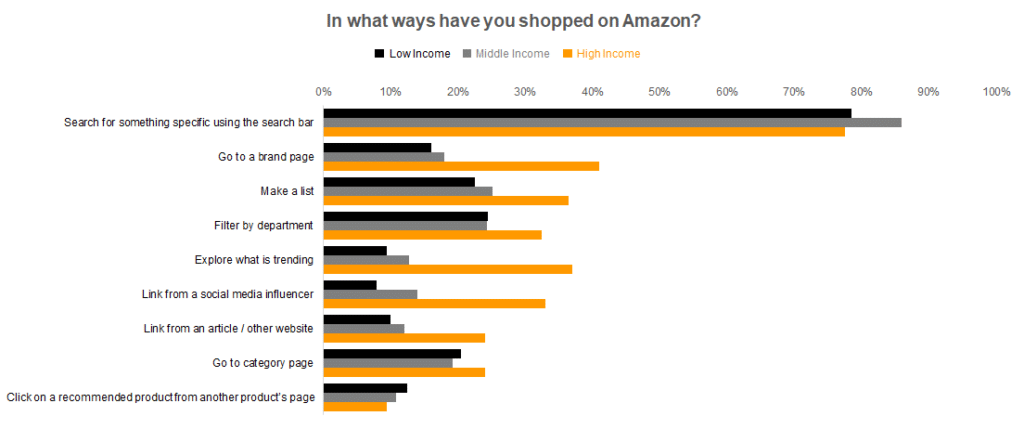

Search remains the most prevalent way to shop on Amazon: According to our study, roughly 80% or more of consumers across income levels reported searching for something specific using the search bar on Amazon. This is well above any other shopping route and reiterates the importance of strong organic rankings and paid search investments. However, high income consumers reported shopping in a wide variety of ways relative to the low and middle income counterparts including: brand store pages (41%), exploring what is trending (37%), making a shopping list in Amazon (37%), filtering by department (33%), and following a link from a social media influencer (33%). Therefore, brands targeting high income consumers may be best served by putting some resources behind these levers, such as brand store pages, advertising placements on department pages, and influencer campaigns.

Source: CRC Amazon Shopper Consumer Study, August 2021, n=650

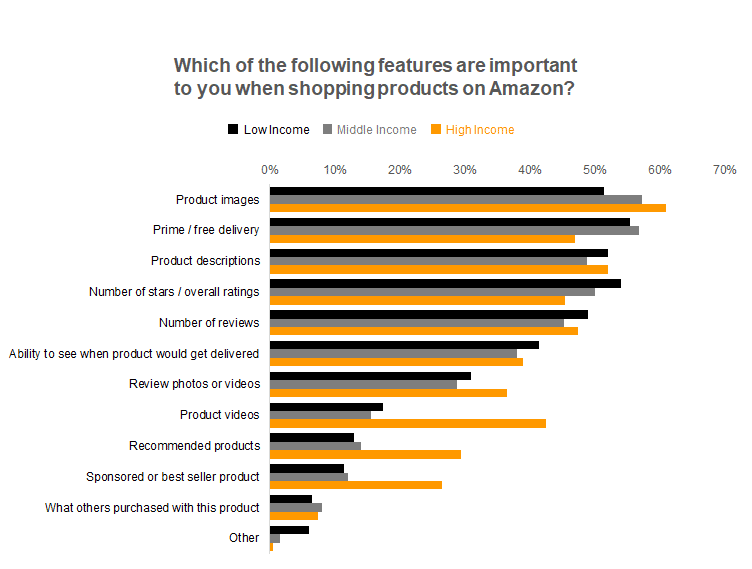

Product images and Prime free delivery are the most important features for consumers shopping on Amazon: Our survey data also suggests there are clear differences across income levels in the most influential product features while shopping on Amazon, which can offer guidance to brands on the types of content and product features that may best drive conversion. This does, however, vary depending on the target consumers. Prime / free delivery serves as the most important feature for roughly 1/4 low and middle income consumers shopping for products on Amazon, compared to only 11% of high income Amazon shoppers. Low income shoppers also see product descriptions as a key feature when shopping. 27% of high income shoppers view product images and video as the most important features, which significantly outpaces low and middle income shoppers.

Source: CRC Amazon Shopper Consumer Study, August 2021, n=650