Amazon aggregators, Amazon labor capacity, Macro labor demand

By Cleveland AdminAmazon aggregators: consolidation, layoffs, and leadership changes:

Recently, there looks to have been an inflection in the aggregator space which has brought on consolidation, layoffs, and leadership changes. We believe a combination of factors including rising costs, elevated CACs, debt covenants, tougher fundraising environment, and more modest sales are leading to disruption and this shakeout in the fairly nascent aggregator industry.

- Rising Costs: Aggregators (like all organizations) are being faced with rising costs across their supply chains. Challenging the economics for aggregators, is the lack of scale benefits gained from using FBA. Specifically, as aggregators grow in size they do not receive reduced FBA rates (as they might with other distributors / logistics companies) as Amazon does not have a vested interest in reducing shipping and warehousing fees since no single seller is big enough to impact their business.

- Modest Sales: Following the pandemic-fueled wave of online sales, digital sales have slowed with eCommerce penetration moving backwards in a some categories as consumers naturally return to brick & mortar channels. While eCommerce penetration will grow long-term, online sales will likely reflect this more modest trajectory over the near-term as brands / companies lap 2-years of strong growth.

- Elevated CACs: In addition to rising shipping and product costs, CPCs and advertising costs have remained elevated adding to the bottom-line pressures.

- Debt Covenants: Much of the money raised by aggregators over the last few years was debt financed and included covenants (protective measures for lenders). So, as EBITDA / profits tighten, many of these businesses may not have the margin flexibility or ability to invest in the business as they previously had.

- Venture Fundraising: On the equity side, raising capital in private markets is more challenging today (compared to ~12-24 months ago) forcing companies to tighten belts and make cash reserves last longer.

These factors combined with the intense competition (especially overseas / Chinese sellers) are leading to the events we have seen over the last few weeks at some of the largest and well-regarded aggregators in the space. As the industry continues to mature, we anticipate further consolidation and evolution of the players in the space. Further, over the long-term we believe many of these companies will look to diversify away from Amazon (likely hard near-term) and also gain brick and mortar exposure over time.

Amazon overstaffed and with excess capacity, likely has positive ripple effects across those hiring:

On Amazon’s earnings call last week, the management team noted that for the first time since the onset of COVID-19, Amazon is no longer chasing physical or staffing capacity – in fact, Amazon is actually overstaffed and has excess capacity leading it to focus on improving productivity and cost efficiencies. This trend is in-line with our macroeconomics research suggesting labor demand has peaked (see below). Given Amazon’s scale, its respite from hiring workers will likely have a positive ripple effect on supply chain and operations across categories as companies look to get back to pre-pandemic capacity. Click here to see our full Amazon 1Q22 results recap.

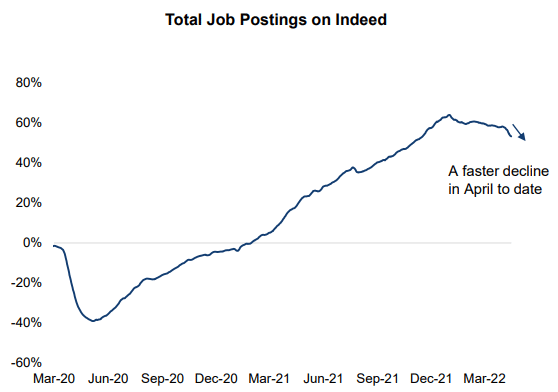

Labor demand has likely peaked with job postings now declining:

Related, CRC’s recent macro report suggested that hiring challenges may begin to ease over the coming months as data suggests U.S. labor demand seems to have peaked. On the supply side, the pace of the labor force return has been stable over the past few months, and another 2.5 million workers may return to the labor force in the next 6 months. New job postings slowed down to ~67% in mid-April, down from the peak of ~89% two months ago.

Note: percentage change in seasonally adjusted job postings since Feb 5, 2020