Amazon Advertising: Share of total retail media & 2021 performance by AMS ad type

By Cleveland AdminFor this edition of 3 Things, we are previewing some highlights and key considerations from our 2022 Amazon Advertising benchmark that will be published Tuesday, June 14th. The study was conducted in May 2022 and was completed by 112 brands and advertising agencies representing over $1.5 billion in advertising spend on Amazon.

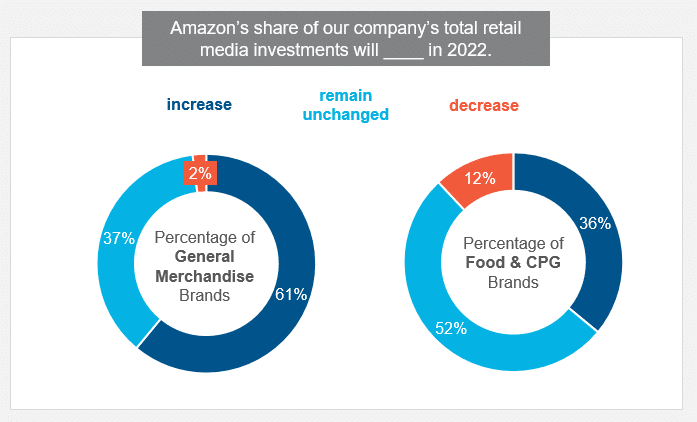

Brands expect Amazon’s share of their total retail media will grow in 2022:

According to our benchmark, net 43% of brands anticipate Amazon’s share of their company’s total retail media investment will increase in 2022. Looking at the split between General Merchandise and Food & CPG brands, a net 59% and net 24%, respectively, are increasing allocation towards Amazon Advertising this year. It appears the slightly less enthusiasm from Food & CPG brands is due to greater current investment on Amazon today as well as further maturity investing into competing retail media networks.

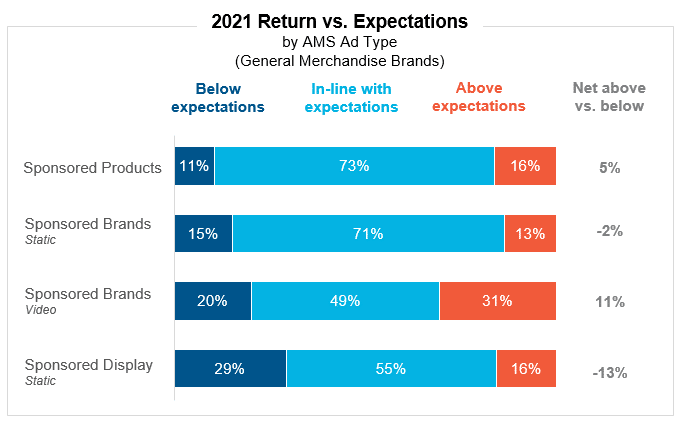

Sponsored Brands Videos beat expectations in 2021:

Taking a look at General Merchandise brands on the AMS/Console platform, it appears that Sponsored Brands – Video ads performed above expectations for a net 11% of brands. Currently, Sponsored Brands – Video make up only about 9% of companies’ total AMS budgets. Sponsored Products followed as the second best performing with net 5% of brands seeing outperformance vs. expectations (off a much bigger base as 60% of AMS dollars are allocated towards Sponsored Products).

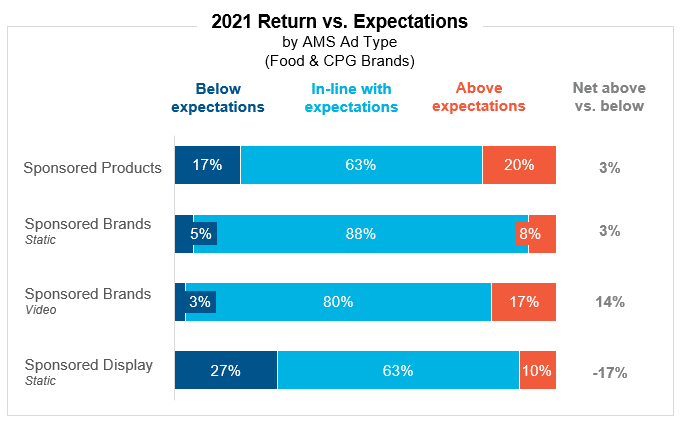

Sponsored Brands Videos also top performance for Food & CPG brands:

In-line with General Merchandise brands, Sponsored Brands – Video performed better than expectations for net 14% of Food & CPG brands in 2021. Sponsored Products and Sponsored Brands – Static ad types also had positive net performance. Given the strong performance of video across categories, we anticipate brands will likely look to increase allocation and resources towards video ad formats moving forward.