Amazon Activations Recovering; Counterfeit Crimes Unit; Highest Outperformance in Two Years

By Cleveland AdminOur research throughout the COVID-19 crisis has suggested manufacturers tended to invest more deeply into AMS so long as they were able to stay in stock. The most recent benchmark suggests that principle remains, as we now see a net positive number of both essential and non-essential manufacturers investing more, on average. Interestingly, AMG spend appears to be seeing a bit of an improvement compared to a month ago. The use of promotional levers saw a meaningful improvement compared to our study a month prior as well. While the overall usage is still net negative compared to before the crisis, it is much less worse for both essential and non-essential categories. This improvement is driven by both Amazon opening up more levers and pent up investment dollars that manufacturers have from either earlier periods on Amazon or, to a lesser extent, other channels that are not growing as quickly at the moment.

Source: Amazon.com

Counterfeit Crimes Unit

This week Amazon announced a new global team focused on preventing counterfeits from being listed on the site. The Counterfeit Crimes Unit, made up of former federal prosecutors, investigators, and data analysts, will also take disciplinary action against counterfeits already found to be on the site. The mitigation of counterfeits is imperative for Amazon in order to maintain customers’ trust in the long term and continues to be a major pain for many brands selling on the site.

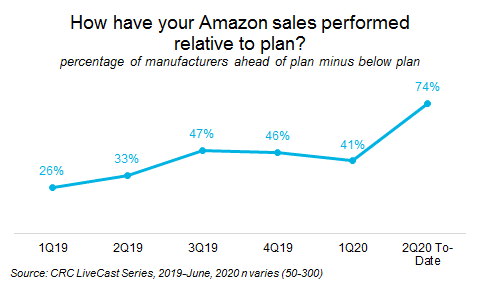

Highest Outperformance in Two Years

According to our benchmarking data from our most recent LiveCast, 84% of manufacturers reported calendar 2Q Amazon sales trends ahead of plan. This compares to only 10% that indicated sales were trending below what they had expected. Outperformance is not surprising given the continued strength of the consumer buying on Amazon and more broadly, other eCommerce channels. However, the magnitude of outperformance (which improved vs. May according to our data) indicates Amazon is in a much better operational position today than at the start of the crisis and is capturing demand across categories.