Amazon 2Q Earnings; Home Depot Enhances Omnichannel; Wayfair Turns Profitable

By Cleveland AdminLast week Amazon reported earnings for what proved to be a phenomenal quarter, despite the high costs related to COVID-19 ($4B+). During the second quarter, the company grew its GMV an estimated $36B+, to ~$113B. To put that in context, this level of incremental growth in 2Q surpassed what it accomplished in 4Q19 and the incremental growth alone is estimated to be more than Walmart’s entire digital business in 2019. Other notable data points included the confirmation of the shift of Prime Day to the fourth quarter and the acceleration of new Prime member growth both in the US and internationally along with an improved member retention rate.

Home Depot Enhancing Omnichannel Distribution:

Due to the increasing demand for delivery and pick-up options, The Home Depot recently disclosed that it plans to open three new distribution centers over the next 18 months. All three facilities will be in Georgia and will serve different purposes, from small packages to big products and same-day and next-day delivery. At the height of the COVID-19 crisis when Amazon displayed delayed shipping times, many noticed consumers opting for retailers that offered BOPIS instead as means of getting product as fast as possible, with Home Depot one of the beneficiaries of this trend. We see this announcement as part of a growing trend of both retailers and manufacturers pulling forward digital investments as a result of the pandemic, attempting to position themselves to continue strong growth in 2021

Source: Corporate.homedepot.com

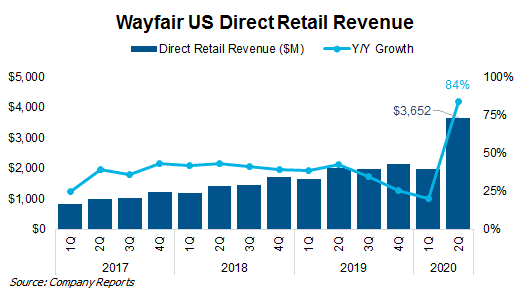

Wayfair Turns Profitable:

Following the trend of pureplay eTailers seeing improving profitability during the pandemic (re: Amazon beat earnings expectation last week with $5.8B in operating profit and Instacart generated profits earlier this year), Wayfair finally turned profitable. The company reported adjusted EBITDA margins of 10.2%, following a negative 5.4% in 2019 and a negative 3.2% in 2018. The positive results were driven by a massive acceleration in volume (US revenue up 83% Y/Y vs. 20% Y/Y last quarter), a reduction in promotions and marketing spend, and a benefit from growing supplier services faster than expected. The company indicated quarter-to-date growth was trending around 70% Y/Y, a deceleration from 2Q, but said it plans to deliver a profitable quarter in 3Q20 as well.