Blog

Pure Play, Mass & Home Improvement Quarterly Results

By Cleveland AdminOur latest Pure Play highlights from 3Q21 featuring insights on Shopify, Amazon, eBay, Wayfair & more.

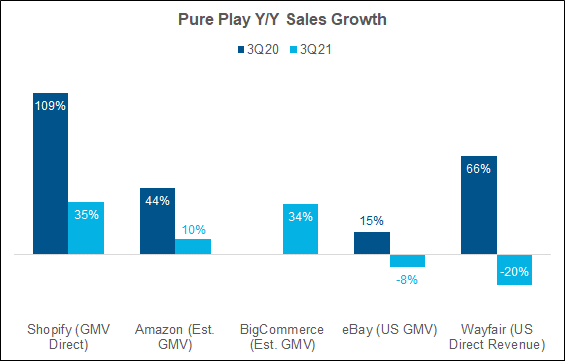

- Shopify had strong growth of 35% this quarter on top of 109% growth in 2020, although revenue and margins were still below expectations due to less online traffic. To offset, the company launched Shopify Markets this quarter, making it easier for sellers to enter new markets, and also introduced TikTok Shopping, leveraging the growing trend of social commerce. Shopify opened a B&M space in NYC with Shopify products, services, and technology for merchants to have a direct connection with the eCommerce platform workers.

- Amazon posted an estimated 10% GMV growth this quarter compared to 44% in 2020 as, similar to Shopify, consumers have continued to return to normal behavior including increased mobility and shifting spend towards travel and services compared to pandemic behavior. Even more notably was Amazon’s disappointing margin performance, having incurred $2bn in incremental costs due to labor, raw material, and transportation cost pressures. Management expects those costs to increase to $4bn in 4Q21.

- BigCommerce showed sizeable growth this quarter at an estimated 34% GMV growth. Key drivers include an expansion into Europe and continuance to offer a flexible platform for merchants of all sizes. In early 2022, BigCommerce expects their “Multi-Storefront” technology to be available to all merchants and plan to continue to further their partnership with shipping and logistics company CMA CGM Group to create a seamless selling experience for merchants using CMA CGM Group to transport goods.

- eBay saw another decline in US GMV of down 8% this quarter, which compares to 15% growth in 3Q20. eBay’s optimism in the quarter stayed focused on its payment solutions, noting that over 90% of global on-platform volume in 3Q was processed through managed payments and that eBay now has 18 million sellers migrated to this payment system globally. eBay also released some new ad types called Promoted Listings Advanced (cost-per-click model where brands choose daily budgets) and Promoted Listings Express (boosts visibility with one-time fee) – in line with retail media trends we are seeing with other retailers.

- Wayfair saw another rocky quarter with US direct revenue declining 20%, compared to growing 66% in 3Q20. Management pointed to supply chain issues and that they still need more time to get back to “normal” Wayfair growth. This past quarter, Wayfair notified brands that they will be testing “Geo-Sort” technology soon (while continuing to use CastleGate logistics), which would recommend products to consumers that are closest to them and in-stock. If the tests are successful, in additional to new fulfillment centers being built, Wayfair expects to be in a much improved supply chain position next year.

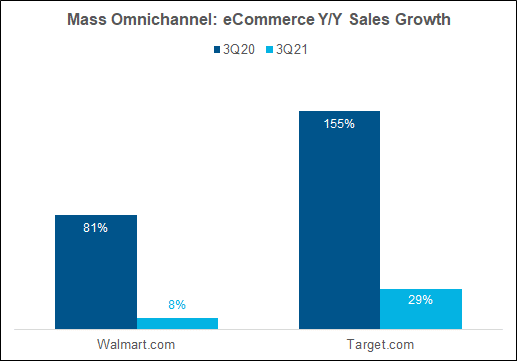

Mass Omnichannel 3Q21 Highlights

- Walmart reported 8% eCommerce growth for the quarter compared to 81% in 3Q20. This was a win for Walmart and management called out that they have been off to a strong start so far in 4Q, servicing demand well with inventory up 11.5% heading into the holidays and hiring an additional 200k associates to help with the anticipated strong holiday demand. Walmart also noted that they feel they are prepared to weather the supply chain and inflation storm, a contrast to other retail giant, Amazon, who missed this quarter in a big way due to these macroeconomic pressures. The marketplace continues to be a focused growth opportunity for Walmart, adding 21mm new items on the marketplace in 3Q and expanding its Walmart Fulfillment Services (WFS) to more sellers as well as external retailers. The company also reported 240% growth in Walmart Connect.

- Target reported impressive 29% eCommerce growth in 3Q on top of 155% growth in 3Q20, continuing to leverage its robust omnichannel capabilities with more than 95% of Targets 3Q overall sales being fulfilled by its stores. Target noted that the back-to-school and Halloween seasons delivered record-setting sales performance this year. However, margin missed due to higher merchandise and freight costs, increased inventory shrink, and heightened labor costs in DCs. Going into the holiday season, Target has already opened two new distribution centers, will be opening two new sortation centers in 4Q and two more in early 2022 which will allow for more capacity and a more efficient supply chain.

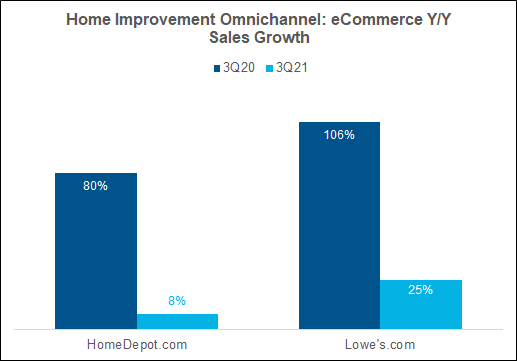

Home Improvement Omnichannel 3Q21 Highlights

- Home Depot reported 8% growth in its eCommerce business, with 2-year growth hitting 95% and 55% of online orders being fulfilled through stores. brings Home Depot’s 2 year online growth to 95%, with 55% of online orders being fulfilled through stores (compared to 60% in 2020 and 50% in 2019). Similar to Amazon, Target, and others, Home Depot cited they expect supply chain issues to continue through 2022 and perhaps even until 2023. Home Depot has made significant investment over the past several years to improve its eCommerce supply chain capabilities and also recently announced a partnership with Walmart’s GoLocal same-day and next-day delivery services.

- Lowe’s digital business grew 25% this quarter, far beyond Home Depot’s growth but still off of a much smaller base, with Lowe’s eCommerce business being roughly one-third the size of Home Depot’s, and penetration being roughly half. Also facing supply chain constraints, Lowe’s announced an initiative to roll out its second market-based delivery network in the Ohio Valley region, following the first market rollout in Florida last quarter. This network leverages a central DC to house bulky products which can be delivered directly to homes.