“Overstocked” Items at Amazon; CVS Media Platform; Retention Expectations

By Cleveland AdminSince July, weighted average inventory amounts at Amazon have remained in normal ranges, although some manufacturers are seeing changes to inventory on certain ASINs (Amazon increasing inventory on high volume ASINs, decreasing on low volume, especially as it preps for 4Q demand). As part of this dynamic, 15% of those surveyed have recently been notified by Amazon that some of their items are overstocked, despite inventory levels that have been considered fine in the past. This communication typically proposed implementing a ~20% discount to move the product more quickly out of the FCs. 45% of those we surveyed that received this communication indicated they ignored it and none have seen negative consequences from doing so at this point.

Source: Amazon

CVS Media Platform:

This week, CVS announced the launch of its new CVS Media Exchange, an advertising platform designed to help brands reach loyal CVS shoppers. With this announcement, CVS joins a growing list of omnichannel retailers that are attempting to follow in Amazon’s footsteps by creating highly profitable advertising offerings. Our research suggests brands are increasingly looking to retailer platforms to help find new ways of targeting and tracking consumers. The uniqueness, usability, and reporting capabilities at each retailer, along with scale, will be key dimensions to secure manufacturers’ budgets. It remains unclear how consumers will react longer-term as these retailers push to monetize their information.

Source: CVS

Retention Expectations:

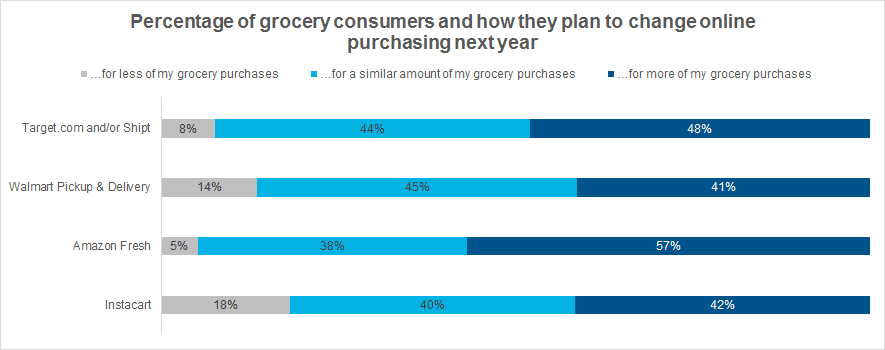

One of the biggest forecasting unknowns for CPG brands is the degree of retention online platforms can expect. Our recent research on the online grocery shopper indicates that consumers plan to continue using online platforms next year at the same or even greater rates compared to last month, despite seeing issues with out of stocks and limited delivery slots. Amazon Fresh scored highest among key rivals, with 57% of its current shopper base indicating they plan to use the service more next year, compared to only 5% that plan to use it less.

Source: CRC Online Grocery Consumer Study, July 17, 2020, N = 1,000 respondents in total, ~380/platform

Subscribe to 3 Things Weekly email

*all fields required